Investors often want to diversify their US-centric holdings with international stock exposure. A common question is which fund they should include and how much they should allocate. This piece will discuss our systematic process for selecting international funds along with which ones we prefer to recommend to clients based on portfolio goals.

INSIGHT

Interestingly, we found Vanguard’s Total International Stock Index Fund (ticker: VXUS), one of the largest and most commonly recommended passive international index funds, came in 8th place using our aggregated, rank-ordered performance methodology. Spoiler alert, this is not one of our preferred recommendations.

As a reminder, we are a fee-only fiduciary advisor and have no compensation arrangements with any of the funds discussed below. These funds were chosen as our preferred options for clients as a result of our own objective research.

Our Process

We looked at more than 20 of the most popular International ETFs screening for funds that have at least five years of historical performance.

We pulled reported trailing market performance on September 1, 2025 from each of the fund’s web pages for 1, 3, 5 and 10 year periods (or whatever timeframe was the furthest available).

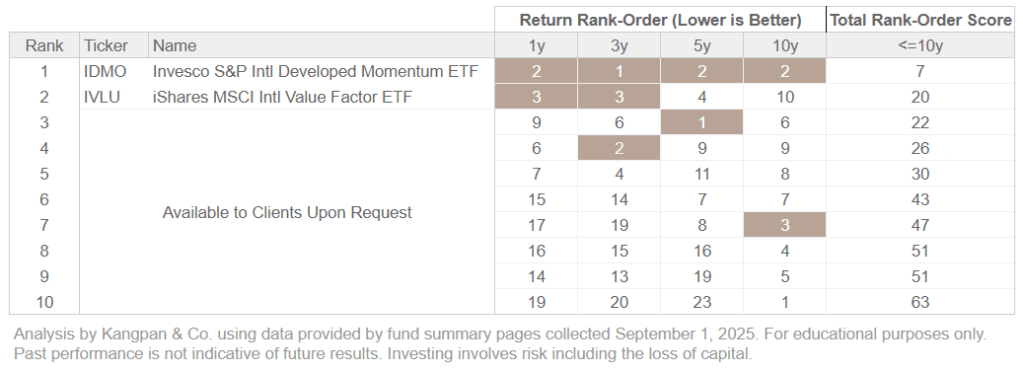

We then assigned a rank-order score to every fund within each performance time period. For example, IDMO was the best performer in the 3 year time period so it receives a rank-order score of “1”. IVLU was the 4th best performance in the 3 year time period so it receives a rank-order score of “4”.

Once each time period was rank-ordered, we then summed the scores across 1, 3, 5, and 10 year time periods to create a composite rank-order score. This final score allows us to sort for aggregated performance across all time periods, rather than focusing on a single one. It also provides an easier way to assess relative differences by looking at the numerical “distance” between the aggregate scores which we discuss a bit more below.

The chart above is a partial snapshot of our analysis. You can see that Invesco’s IDMO was a strong performer across all time periods which resulted in an aggregate score across every period of “7.” The second best performer across all time periods was iShares’ IVLU with an aggregate score of “20.”

This distance 13-point difference between IDMO and IVLU is significantly larger than the 2-point difference between IVLU and our third place performer. This is where the aggregated distance score helps us not only objectively rank-order the funds we assessed but also gives us a straight-forward heuristic to measure their relative differences.

Additional Considerations

Of course, just simply screening for trailing performance shouldn’t be the only consideration when selecting funds. We’re not short term performance chasers. We also look at other aspects of each fund including:

- Fund Strategy: It shouldn’t be a surprise that we prefer simple, systematic strategies that are easily explainable and repeatable over purely discretionary decisions.

- Stress Tests: We looked at the drawdowns during recent stress periods such as 2022’s stock and bond dual decline to understand how different funds held up under duress.

- Correlations: We want an International strategy that provides some level of diversification from other major asset classes within a portfolio, especially vs. US Large Cap holdings.

A walkthrough of these additional analyses along with our full dataset are available to clients upon request.

Funds We Like

Here’s where we’ve landed after our assessment of the International ETF landscape. For clients that want:

- Higher Returns with More Risk: Invesco’s International Momentum ETF (IDMO) had consistent outperformance across multiple time periods vs. most of the other funds we looked at. However, we also saw greater drawdowns during some of our stress test periods vs. IVLU and VYMI along with higher correlations to the S&P 500.

- Diversification and Less Volatility: iShares’ International Value ETF (IVLU) was our second-highest rank-ordered fund across time periods. Although slightly lower returns across time periods than IDMO, this fund also tended to exhibit better resilience during stress periods.

- Income: Vanguard’s High Dividend International ETF (VYMI) was just short of having 10 years of trailing return data but ranked fairly well when looking across 1, 3, and 5 year time periods. The appeal is in it’s twelve month distribution yield which was approximately 3.90% as of September 12, 2025 – higher than the TTM yield on both IVLU’s 3.60% and IDMO’s 1.92%. That extra 30 bps of yield compared to IVLU equates to $3,000 more per year in pre-tax income for every $1,000,000 invested.

We incorporate International funds into many of our Core investment strategies and provide advice on how to add International exposure into portfolios on a project basis.

If you’d like to discuss anything in more detail, reach out to your dedicated advisor if you’re a current client or email us to learn more about our services.

email: [email protected]

Disclosures:

This content is for educational purposes only and is not an investment recommendation. Speak with a licensed financial advisor before making any changes to your investments. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital