Wait, CLOs? That sounds vaguely like those things that blew a hole through the economy back in 2008… Close, but it was actually CDOs that contributed to the meltdown. According to VanEck’s William Skol:

“… not only did CLOs have nothing to do with the Global Financial Crisis, the asset class thrived through the 2008 crisis relative to other fixed income asset classes.”

Read on if you’re:

- Looking for ways to increase yield in your portfolio without taking on significant credit risks

- Interested in alternative credit options available in liquid forms

As a reminder, we are a fee-only fiduciary advisor and have no compensation arrangements with any of the funds discussed below.

A Quick CLO Primer

The love of TLAs (three-letter acronyms) within the financial world plays a part in this confusion between CDOs and CLOs. I spent a summer internship back in the mid-2000s structuring both these and other derivatives, and I still had trouble keeping all the acronyms straight as I was completing my rotation on the desk.

Collateralized Debt Obligations (CDOs) can be comprised of a variety of debt instruments including unsecured and junior obligations. It was sub-prime mortgage CDOs that played a dominant role in the 2008 collapse. We’re not going to cover CDOs any further in this post.

Collateralized Loan Obligations (CLOs) are a form structured credit that are generally backed by senior secured loans from corporate borrowers. Senior meaning first in line to be paid if a company experiences financial troubles. Secured meaning they are backed by the company’s assets.

The underlying loans within a CLO are also usually both liquid and tradable. Each CLO is generally made up of 150-250 individual loans. These loans are then further divided into a layered loss structure called “tranches” where losses are absorbed by each layer in a cascading sequence.

These layers are rated like other credit instruments from CCC (the riskiest) to AAA (the least risky). In order for AAA-rated CLO tranches to take a loss, all other preceding layers need to have blown out. This makes the AAA-rated CLO tranche a relatively lower risk investment vs. other corporate credit options out there.

How much lower risk? As the fixed income team at BlackRock points out in their March 17, 2025 article:

” … no AAA-rated CLO has ever defaulted.”

I recommend checking out both the VanEck and BlackRock articles linked above for a more in-depth overview.

JAAA ETF Overview

CLOs have been around for decades now but only recently became available in a more easily accessible, liquid ETF form. They come in a variety of versions including those focused just on AAA-rated tranches which is what we’ll spend the rest of this post discussing.

There are multiple AAA CLO ETFs available (that’s three TLAs in a row if you’re keeping score), but we’ll use Janus Henderson’s (ticker: JAAA) for our analysis which is both the largest by AUM and the one that has been around the longest. Here’s a quick rundown of JAAA’s core attributes:

| Metric | JAAA |

| Closing Market Price | $50.68 |

| 30-Day SEC Yield | 5.39% |

| Net Annual Expense Ratio | 0.20% |

| Number of Holdings | 453 |

| Effective Duration (Yrs_ | 0.12 |

| Returns YTD 1y 3y | 3.51% 5.85% 7.02% |

Via https://www.janushenderson.com/en-us/advisor/product/jaaa-aaa-clo-etf/ ; data as of close on September 17, 2025 except returns which are as of August 31, 2025 and represent total average market-price returns including distributions

Beyond JAAA’s yield and performance, one of the most important characteristics of JAAA is its very low duration of 0.12 years which (a) gives this fund’s price very low interest rate sensitivity and (b) essentially makes this a floating rate investment.

We need to put JAAA’s performance in context by comparing against a benchmark asset. Here are a few key traits we need to consider when selecting a comparison asset:

- A fixed income investment

- Invested in AAA-rated credits or higher

- With a very short duration

These attributes make the iShares 0-3 Month Treasury Bond ETF (ticker: SGOV) a solid contender to compare as the benchmark which is a fixed income product, invested in government debt, with a duration of just 0.09 years. Here are the attributes side-by-side:

| Metric | JAAA | SGOV |

| Closing Market Price | $50.68 | $100.57 |

| AUM | $25.2 billion | $57.7 billion |

| 30-Day SEC Yield | 5.39% | 4.19% |

| Net Annual Expense Ratio | 0.20% | 0.09% |

| Number of Holdings | 453 | na |

| Effective Duration (Yrs) | 0.12 | 0.09 |

| Returns YTD 1y 3y | 3.51% 5.85% 7.02% | 2.1% 4.51% 4.80% |

– JAAA data via https://www.janushenderson.com/en-us/advisor/product/jaaa-aaa-clo-etf/

– SGOV data via https://www.ishares.com/us/products/314116/ishares-0-3-month-treasury-bond-etf

– Data as of close on September 17, 2025 except returns which are as of August 31, 2025 and represent total average market-price returns including distributions

A current yield spread of 120 bps and a persistent 134 bps increase in returns vs. short-term treasuries across time periods seems pretty good for a AAA-rated fixed income alternative with similar duration. So what’s the catch?

JAAA’s Historical Drawdowns

While the total return for JAAA has exceeded those of SGOV since JAAA’s launch, that return has come with a bit more volatility.

Unlike short-term treasury funds, short-term AAA CLOs ETFs can and have experienced notable drawdowns due to increased credit exposure and other factors. Let’s explore what these drawdowns have been.

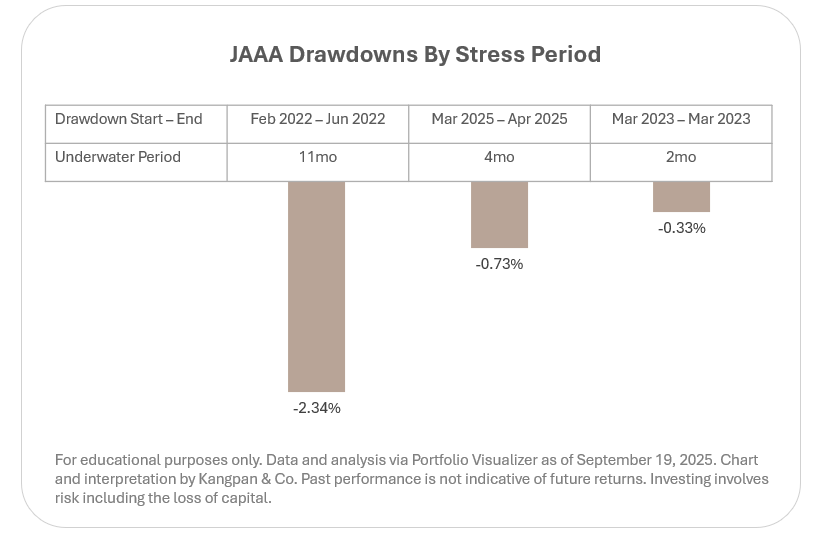

AAA CLOs have existed for decades but JAAA itself has only been around since October 2020. That means we can only look at a handful of stress periods to get a sense for how well it has held up. The chart below shows the three largest drawdowns for JAAA since launch with the following data points:

- The start month of each drawdown and the end month when the lowest price was hit for that stress period

- The Underwater Period which is the length of time between the drawdown start date to when when the investor fully recovered their initial investment inclusive of reinvested distributions

- The max % total loss experienced (i.e. inclusive of distributions) during the drawdown

The largest drawdown was during 2022, aka the worst overall bond market since 1949 according to Bank of America and other bond analysts. JAAA’s drop during this time was primarily due to the aggressive rate hikes that resulted in a repricing of CLOs across the board along with increased trading activity among various market participants. However, it’s important to note that the relatively short Underwater Period of 11 months can be attributed to two key factors:

- The very short duration of JAAA’s holdings which significantly reduces interest rate sensitivity as the holdings mature essentially making its holdings floating rate instruments so as the interest rates ratcheted up, the underlying holdings increased yields with less price impact than many other fixed income investments

- The underlying changes to NAV were not due to credit issues given none of the holdings defaulted during this time (and, if you recall from earlier, no AAA CLO has ever defaulted as of the date of this post).

While by no means risk-free, we feel JAAA has held up fairly well under a relatively limited set of stress scenarios. That said, there are other considerations an investor should look into as well when assessing an investment like this such as tax implications, target interest rate exposure, etc.

Client Portfolio Strategy

Like many alternatives, AAA CLO ETFs aren’t necessary or even appropriate for every portfolio. Here are common situations where we think about utilizing these investments:

- Clients with income-centric portfolios that want to enhance their yield within their short-term exposures without taking on significant credit risks

- Clients with large cash and other liquid holdings that want to further enhance their yield for funds they are not anticipating needing within the next 1-2 years

There are other situations where we would consider including these liquid alternatives in portfolios based on client needs and risk tolerances which we help clients model out and understand the expected benefits and implications in doing so.

If you’d like to discuss anything in more detail, reach out to your dedicated advisor if you’re a current client or email us to learn more about our services.

email: [email protected]

Disclosures:

This content is for educational purposes only and is not an investment recommendation. Speak with a licensed financial advisor before making any changes to your investments. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.