This post provides a quantitative analysis of the tradeoffs between using a short-term treasury ETF like SGOV vs. popular High Yield Savings Accounts (HYSAs) for large cash positions. We also discuss the practical differences between the two approaches.

This is analysis is one of dozens of analyses we do for every Portfolio Efficiency Diagnostic we run for our clients.

We frequently come across large cash positions being held in High Yield Savings Accounts (HYSAs) when we’re onboarding new clients. These are typically being reserved for big ticket items like a home purchase (upgrades or second homes) or other uses that don’t require same-day liquidity. Our clients tend to also have high incomes and live in high tax states resulting in significant state taxes on cash positions held in these HYSAs.

We think every data point and item in a client’s financial strategy is worth analyzing and optimizing. But the after-tax yield of our clients’ cash positions is one that we frequently find significant opportunities for improvement.

We have nothing against HYSAs, they are simple to manage and they are great for earning a yield on funds you use to pay expenses. However, they can be sub-par when used as a savings vehicle for big-ticket purchases or as cash that you don’t need immediate, same-day access to. We feel short-term treasuries can meet this need better, specifically via an ETF which streamlines purchasing and reinvesting in treasuries on an ongoing basis.

SGOV Currently Yields More Than Many Popular HYSAs

We’ve compiled the rates being paid by some of the more popular HYSA’s out there as of October 31, 2025:

- Marcus by Goldman Sachs – 3.65%

- American Express Personal Savings – 3.50%

- Capital One – 3.40%

- Ally Bank – 3.30%

For comparison, the iShares 0-3 Month Treasury Bond ETF (ticker: SGOV) had a 30-day SEC yield of 3.98% as of October 31, 2025. As a reminder, we are a fee-only fiduciary and do not accept commissions or have direct compensation arrangements with any third party providers.

It’s also important to note that yields on short-term treasuries, like the yield on an HYSA, will fluctuate with federal interest rates and other factors. The absolute and relative differences between the accounts above and a fund like SGOV are based on the dates we pulled the data and will be different over time.

Tax Policy Differences May Understate How Much Higher SGOV Yields for High Earners

The difference in yields between SGOV and the popular HYSAs listed above is immediately apparent. This difference is even more stark if you live in a high-tax state like New York, New Jersey, or California. This is because interest on high yield savings accounts in both of these states is taxed; the interest from treasuries is generally exempt from state taxes.

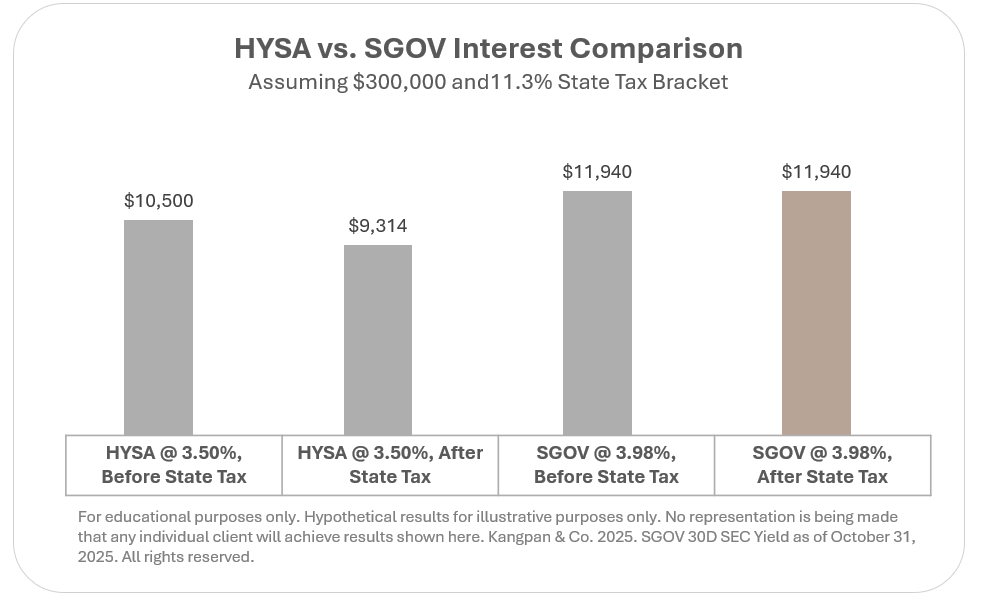

Let’s bring this to life with a concrete example. Imagine you and your spouse both work high-paying jobs in California. One of you is in tech and the other is in the medical field. Together you earn $1.2 million a year putting you in the 11.3% CA state income tax bracket (assuming Married, Filing Jointly). You’re saving to put a down payment on a second home and have $300,000 stashed in your HYSA earning 3.50%.

Here’s how much that $300,000 currently earns before and after state taxes between your HYSA vs. in a short-term treasury fund like SGOV:

You could end each year with $1,440 more in pre-tax interest by moving your HYSA savings into SGOV on the rate difference alone . This jumps to $2,626 more each year once you take into account the impact of state taxes on the HYSA interest on which, once again, SGOV interest is generally exempt. Note, these figures are before federal taxes which would further decrease all of these.

So What are the Differences Between a Short-Term Treasury ETF and an HYSA?

We are not advocating that every high earner in a high-tax state should switch from their HYSA to a short-term treasury ETF for their large cash positions (and especially not for cash held for day to day expenses or immediate liquidity needs). However, we do think everyone should at least understand the numbers behind the different options for their particular situation. From our experience, many high earners are leaving significant amounts of money on the table by keeping their large cash savings in HYSAs.

There are different mechanics of building and saving in an HYSA vs. short-term treasury ETF. The main considerations between holding your large cash positions in a high yield savings account vs. in a short-term treasury ETF like SGOV are as follows:

| High Yield Savings Account | Short-Term Treasury ETF | |

| Risk Levels | Very Low Up to $250,000 per depositor, per institution is protected by FDIC insurance at federally insured banks and credit unions | Very Low The underlying treasuries are backed by the US government and are considered the “risk free” benchmark by most financial companies |

| How to Access | Set up an account with a HYSA provider, connect your bank account, and then set up one-time or recurring transfers | Buy the ETF through a brokerage account; set up automatic reinvestment to further streamline the process (optional) |

| Withdrawing Funds | Initiate a transfer to your linked checking account; some HYSAs also allow access via an ATM or check writing | Sell ETF shares to reach the amount you need then transfer those funds a to bank account once the trades have cleared |

| Withdrawal Limits | Some HYSAs may impose limits on withdrawals (amount or frequency) | None |

| Interest Subject to Federal Tax | Yes | Yes |

| Interest Subject to State Tax | Yes, in most cases | Generally exempt |

Speak with a licensed advisor if you’re unsure how to examine your situation or if you want more guidance on how to switch from a savings strategy built on using a HYSA to one centered around short-term treasuries.

As we mentioned earlier, this is part of a standard series of diagnostics we run for our clients to ensure their financial system is running optimally. Reach out to us to schedule a complimentary, 30-minute Portfolio Efficiency Diagnostic Preview if you’d like someone to systematically examine your entire financial footprint to identify more opportunities such as this to improve your after-tax returns.

email: [email protected]

If you liked this post, you should check out our piece on the basics of tax-efficient asset location or comparing fees on your S&P 500 position.

Disclosures:

This content is for educational purposes only and is not investment, tax, or legal advice. Employees and clients of Kangpan & Co. may hold positions in securities discussed in this post. Speak with a licensed tax, legal, or financial advisor before making any changes to your investments or financial strategies. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.