This is a post that provides details on why and how to gift donated stocks / securities as part of your charitable giving strategy.

Charitable giving doesn’t have to be limited to just cash.

Many of you will be looking to provide some extra support to various causes and charities as the year start drawing to a close. You’re probably already aware that cash donations to qualified, tax-exempt organizations are tax-deductible if you choose to itemize.

Most of you are also sitting on some significant capital gains as the markets have run up throughout the year – leaving you with some large capital gains taxes if you decide to rebalance or lock in those returns.

What if you could support a cause you believe in, eliminate those short-term gains taxes, and still get a tax deduction for your donation? This is where gifting appreciated stocks and other securities comes in.

How to turn taxes into incremental charitable giving impact

We like to illustrate concepts through simple examples.

Imagine you and your spouse live in NJ and make a combined $450,000 a year. Your marginal federal tax rate is 32% and your state tax rate is 6.37% on your earned income. Because you are fortunate enough to be considered a high-earning household, you also owe an additional 3.8% NIIT on any investment income such as capital gains.

You and your spouse enjoy being an active part of the community by supporting your local charitable organizations each year with $10,000 in donations.

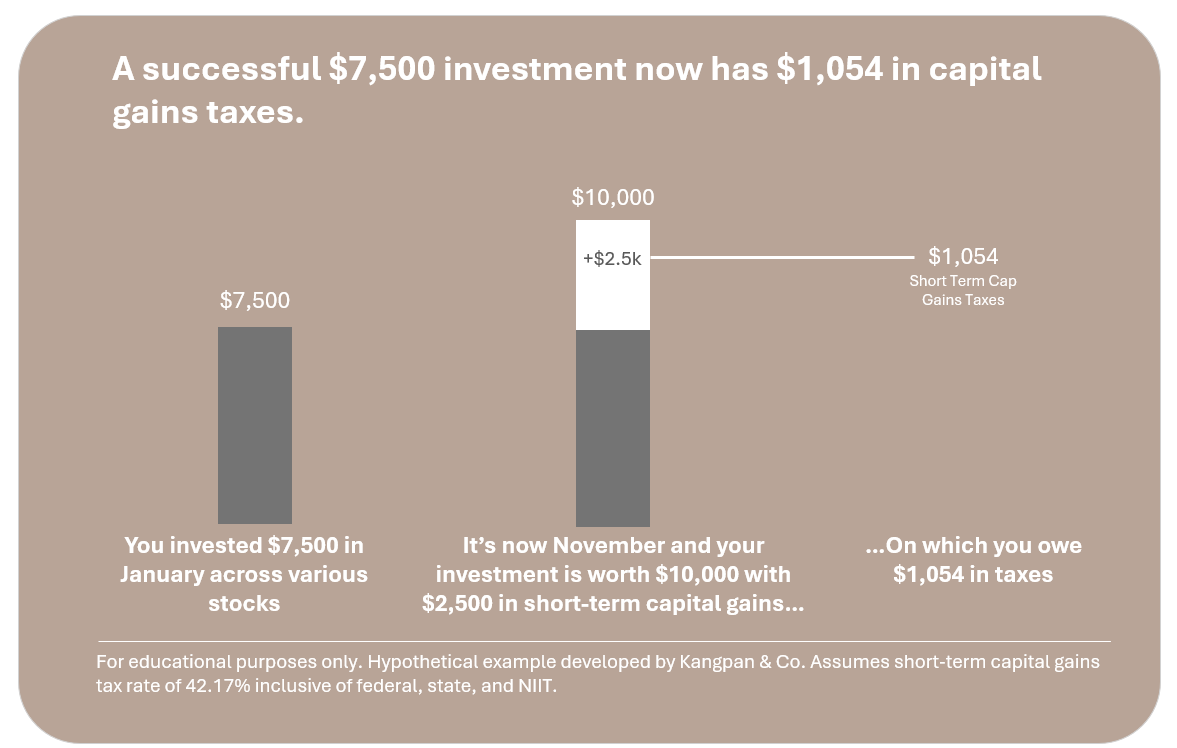

Now, let’s say you made some AI-centric bets at the start of the year and invested $7,500 across Nvidia, Microsoft, and Google and you’re now sitting on short-term capital gains of ~33.3% year to date. Your investments are now worth $10,000 and you’d like to sell out of to rebalance your portfolio and capture some of these gains. But selling out will result in more than $1,000 of capital gains taxes.

Here’s the math:

$1,054 isn’t that much in the grand scheme of things for a couple making $450k a year, but it’s still something that would be better to offset than to pay out of pocket. We believe in paying the taxes you owe, but we also like to help clients figure out how to avoid leaving an additional cash tip with the IRS – especially when those funds can be given to causes that are important to our clients.

Instead of selling out your position, you can donate your stocks instead. By donating this $10,000 of appreciated stock to a qualified organization, you can:

- Support your causes and charities: You are still directly giving $10,000 to your desired charitable organizations.

- Eliminate $1,054 of capital gains taxes: Qualified charitable organizations do not pay capital gains on donated stocks and securities.

- Get ~$3,837 in tax benefits via donation deductions: If you’re itemizing your donations, you will be able to deduct the $10,000 stock donation (i.e. inclusive of the gains) from your gross income.

You’ve now turned a $1,054 capital gains tax bill into an incremental $4,891 of optimized charitable impact ($1,054 saved cap gains + $3,837 tax deduction benefits).

How to donate stocks and other securities

So you’re sold on the idea of donating some of your appreciated stock this year. How do you do it?

Give Directly

Some organizations will allow you to donate stocks and other securities directly. Just ask the causes or charities you support if they’ll accept these kinds of donations and what their preferred steps are.

Set up a Donor-Advised Fund (DAF)

We feel one of the more flexible options is to set up a Donor-Advised Fund at a bank or brokerage firm which allows you to flexibly gift your assets to the fund whenever you’d like, keep those funds invested within the DAF, and then distribute your funds in the form of a check directly from the DAF whenever you want to provide your donation. Speak to a licensed advisor if you’d like to learn more about the pros and cons of using DAFs to manage your charitable giving.

Developing and managing charitable giving strategies like this one is just one of the hundreds of continuous improvements that our Diagnostic-driven approach systematically optimizes to help clients achieve quantifiable outcomes across all their financial goals. Email us for a complimentary consultation with an advisor if you’d like to learn more about how you can strategically manage your taxes while also finding ways to give more effectively to your charitable causes.

email: [email protected]

Disclosures:

This content is for educational purposes only and is not investment, tax, or legal advice. Employees and clients of Kangpan & Co. may hold positions in securities discussed in this post. Speak with a licensed tax, legal, or financial advisor before making any changes to your investments or financial strategies. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.