Welcome to 2026, a tax optimization case study, inflation and 60/40 portfolios, The View from Ninety

Dear Friends and Client Partners,

I hope your year is off to a great start and that you got to unplug a bit during the holidays. We spent a week visiting Sheila’s family in Wisconsin enjoying the change of pace and scenery while dipping many dairy-based foods into other dairy-based condiments.

One of the reasons I got into wealth management was the desire to have a direct and measurable impact on the financial lives of the clients I serve. I’ll be highlighting case studies in some of these notes to showcase the impact we’re having on our growing client base and to help spark additional planning and investing ideas outside of our regularly scheduled meetings.

Tax Optimization for High Earners – A Case Study

Today’s case study is an example of how Kangpan & Co.’s growing proprietary capabilities helped uncover core tax optimizations that our clients’ previous advisor was overlooking. There is nothing more rewarding than providing immediate, tangible results within the first few conversations with a new partner. As the clients in this case mentioned in our latest review session:

“It’s hilarious just how much better your approach is compared to our old advisor… He never talked to us about any of this.”

Our clients are a high-earning, married couple in their 30’s living in New York. They have a combined income in the high six figures. They came to us because they were unhappy with the advisor they were working with at the time, sensing (correctly) that their old advisor was overlooking many strategies that could help them put thousands more a year towards their financial goals.

We started the relationship by building a comprehensive, dynamic financial plan that would help us fully understood the couple’s financial situation as well as their short, medium, and long-term goals.

Once we had a holistic picture, we were able to focus our detailed series of diagnostics on the critical tax, planning, and investment optimizations that would help them put thousands more per year towards their goals.

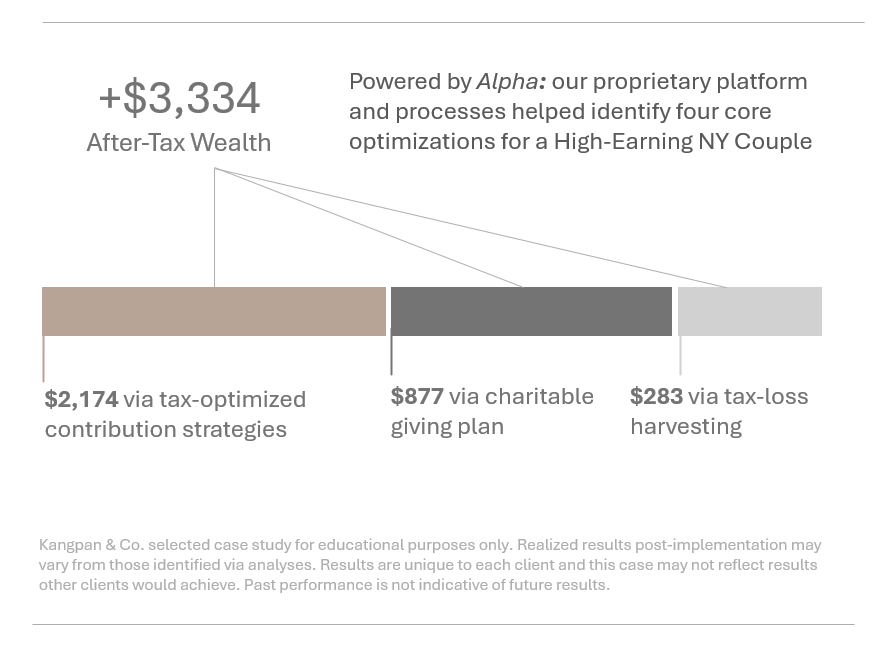

We went through our full suite of tax, investment, and planning diagnostics during the onboarding process. While we delivered value across all three of those categories, we want to use this case study just to highlight the key tax opportunities we identified:

- Saving for College Before the Stork Arrives: The couple are planning to but do not yet have children. Like many of us, they prioritize college savings in their long-term financial goals and were planning on opening a 529 Plan once they had children. Many couples are unaware that you can open 529 Plans before your kids are born to a) get a head start on saving but also b) start taking advantage of the tax benefits now. We modeled out the tax and long-term savings impact of our clients starting their 529 this year and also helped them set up and fund their account to begin taking advantage of all the tax benefits.

- Health, Wealth, and a Triple-Tax Advantage: One of the clients has had an HSA for years into which their employer has been contributing $1,000 a year. However, the client had not been adding any additional funds since they felt they were young and healthy and had no need for putting funds into the HSA. We walked through the triple-tax advantages of HSAs and discussed how HSAs can function like an additional retirement account once they turned 65… when the funds could be tapped penalty-free for non-healthcare spending.

- Maximizing Charitable Giving By Waiting for the New Year: Our clients donate to several charities each year. While the amounts are generous, they are not high enough for our clients to itemize. However, in 2026, the OBBBA tax changes will allow couples filing jointly to deduct up to $2,000 in qualified charitable cash donations, even if they take the standard deduction. Based on this change, we advised our clients to wait until at least Jan 1, 2026 to make some of their planned donations to take advantage of this new deduction policy.

- Continuous Tax-Loss Harvesting: We identified and realized multiple tax-loss harvesting opportunities as we migrated the clients’ portfolios towards our recommended allocations. While many advisors only look at tax-loss harvesting once a year (if that), we implement it year round to continuously capture opportunities as they present themselves.

These four optimizations alone added up to more than $3,334 in additional after-tax income that our clients will be able to build year after year. Note: this couple has graciously offered to serve as a reference for any of you reading this who are not yet clients.

Food for Thought

A collection of articles or books I’ve read since the last post that might be interesting to many of you.

- Inflation Risk is Still Under-Appreciated by Investors via the Financial Times: As the FT notes:

“Indeed, half of the worst drawdowns for traditional stock-bond portfolios occurred during inflationary episodes that triggered central bank rate hikes in the 1970s and 1980s — and most recently in 2022.”This is one of the reasons we advocate diversifying beyond stocks and bonds in your portfolios into alternative asset strategies like managed futures.”

- The View from Ninety by Charles Handy: Handy spent his career writing and talking about organizational behavior and work-life balance. This is his final book and is mostly a quick, light philosophical musing for busy professionals running through the corporate grind. A key nugget in here for those of you questioning what else is out there:

“… it’s very tempting to opt for ‘freedom from’ by pursuing a career that offers a fair guarantee of work and money for the rest of your working life. But then, like me, you will feel frustrated because really, secretly, you will want the ‘freedom to’ – the freedom to do what suits you better.”

- One of Handy’s other books, the Elephant and the Flea, had a significant influence on me leaving the corporate world to start Kangpan & Co.

Thank you for the continued partnership and for the opportunity to help steer your family’s capital toward what matters most.

Nathan

Founder & Lead Advisor

Not a client yet? Subscribe to this bi-monthly client newsletter for free to see all the engineered tax, investing, and planning strategies we run for investors like you.

Disclosures:

This content is for educational purposes only and is not investment, tax, or legal advice. No post is an endorsement of any particular strategy or security. We do not receive any direct payments or commissions for securities discussed in our posts. Employees and clients of Kangpan & Co. may hold positions in securities discussed in posts. Speak with a licensed tax, legal, or financial advisor before making any changes to your investments or financial strategies. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.

The case discussed in this post is a real-life client case study. The clients in this case study have agreed to be featured in Kangpan & Co.’s materials without any form of direct or indirect compensation. All results are specific to each individual client’s unique circumstances and may not be representative of results other clients would achieve.