Overview

For Investors That Want More From Their Investment Managers

Investors often wonder what makes each firm’s investment approach unique. We believe investors choose to partner with us on their investing needs vs. other managers because we provide:

- Systematic Optimization: We use structured Investment Management Playbooks to go beyond investment selections to help optimize all the other aspects of your portfolio strategy like minimizing tax drags, determining rebalancing frequencies, helping you stick with your strategy, etc. Research from Vanguard shows this type of comprehensive approach to investment management is where more engaged advisors like us can add up to 3% in yearly net returns1.

- Engineered Resilience: We’re not just going to default to recommending a passive 60/40 with a single, annual rebalance. We focus on building Core investment strategies that aim for optimized risk-adjusted returns and greater resilience across market cycles than traditional Stock / Bond portfolios through the selective incorporation of factor exposures and alternatives. See more in the Core Portfolios section below or read more about our focus on resilience.

- Structured Diversification: We believe low-correlation, liquid assets can both enhance returns and diversify risks within traditional portfolios. We partner with clients who want alternative exposures to understand how assets such as gold, managed futures, alternative credit, and even digital assets can be incorporated into their portfolios in ways that align to their investment objectives and risk tolerances.

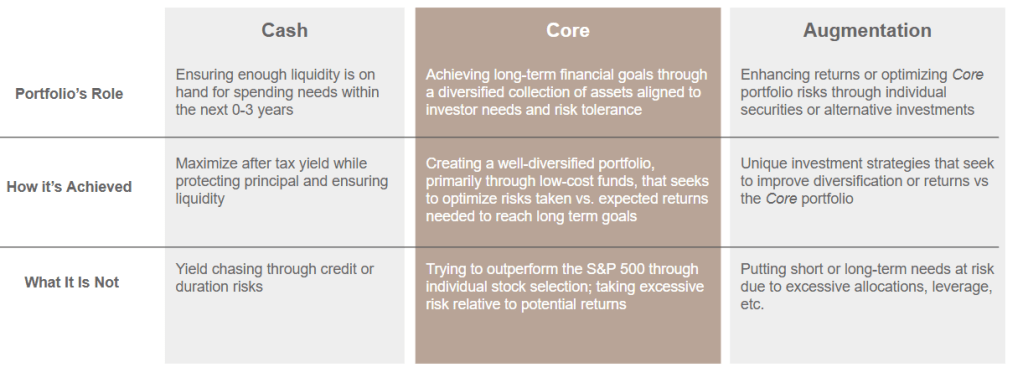

We believe a comprehensive investment plan is comprised of three different strategies that serve dedicated roles within an investor’s financial portfolio. See “Our Investment Strategies” section to learn more about each of the portfolios below.

A quick note on performance reporting and account structuring:

Portfolio Returns

While we are strong proponents of process transparency, we prioritize firm regulatory compliance. Our strategies are considered proprietary and individualized to our clients so we cannot publicly display returns at this time. To discuss the expected returns, risk metrics, and Systematic Resilience of our portfolios in detail, please reach out to us at: [email protected]

Individual Accounts

Our portfolios are generally run as Separately Managed Accounts (SMAs) within client accounts at our custodian, meaning you retain direct ownership and visibility of every underlying security. This is essential for our ability to provide continuous, individualized investment advice and portfolio efficiencies (e.g. tax-loss harvesting, asset location strategies, etc.).

1. According to third party research conducted by Vanguard. Not a guarantee of results for any particular client. Past performance may not be a predictor of future returns. Speak with an advisor to understand your specific needs and potential optimization opportunities.

Core Portfolios

Our Core Portfolios are designed to be the reliable engine that takes our clients from where they are today to where they want to be while reducing the bumps along the way. We use traditional stock and bond portfolios as a starting point and then mix in factor exposures and alternatives in order to optimize for risk-adjusted returns. We believe this focus on effective offense through smart defense is a more systematically resilient model for long-term wealth management.

Core Portfolios are primarily comprised of diversified ETFs across stocks, bonds, and alternatives which are generally held for the long term against strategic allocation targets across market and economic cycles. We continuously research and improve our asset management strategies and incorporate these learnings over time within these portfolios.

Learn more about how we develop our Core Portfolios here or read about how we use alternatives such as gold to diversify traditional portfolios.

We currently offer three Core Portfolio strategies:

| Core Portfolio | Details |

| Aggressive | Engineered for investors who prioritize the long-term growth of their net worth. This strategy pursues optimized risk-adjusted returns and Systematic Resilience relative to a traditional portfolio of 90% US Large Cap / 10% US Bonds. Target Allocations: – 80-100% equities – 0-20% fixed income – 0-20% liquid alternatives |

| Balanced | Designed for investors that seek to balance growth and preservation of assets across market cycles. Aims for long-term, optimized risk-adjusted returns and Systematic Resilience relative to a traditional portfolio of 60% US Large Cap / 40% US Bonds Target Allocations: – 40-80% equities – 30-70% fixed income – 0-20% liquid alternatives |

| Conservative | Developed for investors that want to prioritize the preservation of what they already have while reducing overall volatility across market cycles. Structured to pursue long-term, optimized risk-adjusted returns and Systematic Resilience relative to a traditional portfolio of 40% US Large Cap / 60% US Bonds Target Allocations: – 20-60% equities – 40-80% fixed income – 0-20% liquid alternatives |

Augmentation Strategies

We implement a variety of Augmentation Strategies to help clients:

- further manage the return and risk profile across their Cash and Core portfolios through alternative asset allocations or the selection of individual securities or funds aligned to our client’s needs

- strategically manage broader financial needs such as diversifying concentrated positions or managing equity compensation

- incorporate funds, individual stocks, bonds, or alternative assets that fall outside of the Cash and Core positions that clients would like to add to their overall financial portfolio

We provide in-depth analysis, guidance, and ongoing asset management to clients seeking to augment their portfolios with these strategies. We may make proactive recommendations to clients when our analyses and ongoing research suggest a particular strategy may be a fit for their investment goals and risk profile.

We have various combinations of systematic strategies we’ve designed to be implemented across multiple client accounts or completely custom portfolios aligned to a particular client’s needs. Examples of Augmentation strategies include but are not limited to:

| Augmentation Strategy | Overview |

| Bitcoin Accumulator | A systematic strategy designed to protect the initial capital outlay while steadily building long-term positions in digital assets. |

| Diversifying / Reducing Concentrated Positions | Customized strategies to help clients manage the risks of large, concentrated positions through broader diversification, tax-efficient selling, etc. |

| Equity Compensation Management | Customized approaches for managing equity compensation on an ongoing basis through tax-efficient and risk profile-aligned strategies. |

| Adding Custom Exposures | Working with clients to understand the returns, risks, and broader portfolio impact of adding individual funds, stocks, bonds, or alternatives to their financial mix |

| Increasing Income | Emphasizing increased, stable income exposures through broader dividend, bond, real estate, and alternative credit assets |

Cash Management

We use our process of Systematic Optimization to develop customized Playbooks to manage our clients’ cash and liquidity needs. This includes developing strategies for short (0-3 months) and medium term (3 months – 3 years) liquidity needs.

We align recommended strategies based on our comprehensive understanding of a client’s goals, risk tolerance, cashflow needs, and general savings strategy that we analyze and optimize through our financial planning process. These strategies could include prioritizing liquidity over yield, selectively enhancing yield for medium-term needs through alternative credit, creating resilience to shocks, etc.

See our posts on maximizing after-tax cash yields or on enhancing yields through alternative credit

Investment Management Playbooks

We focus on the Systematic Optimization of your entire investment approach through the continuous research of asset selection, efficient portfolio management, and all other aspects of investment management that could impact you and your portfolio.

We are continuously breaking investment management down into individual components that can be identified, analyzed, and then optimized. We then compile what works and aligns to our clients’ needs into Playbooks that allow us to systematically and methodically apply our learnings.

Areas we research regularly include, but are not limited to:

- Portfolio Backtesting: Refining how we construct and test portfolios with a focus on understanding underlying asset correlations, potential future risks, and historical stress testing under different economic scenarios

- Asset Selection: Identifying optimal ways to express our investment philosophy through the screening and selection of asset classes, funds, and individual securities

- Tax Planning: Focusing on tax-efficient investing via asset location, tax-loss harvesting, and other optimizations.

- Monitoring: Improving the monitoring of portfolios to identify when shifts in target allocations or other triggering events may require action.

- Rebalancing: Determining the method, frequency, bands, and triggering events to keep portfolio allocations aligned towards meeting our clients’ goals

- Reporting: Enhancing and streamlining portfolio and performance reporting for our clients to make key insights and takeaways easier to identify and interpret

We will regularly meet with you to review results, new recommendations / research, and notable updates we’ve made to your portfolio and our Playbooks.

Email us to set up time to talk to one of our advisors and learn more about our investment management services.

email: [email protected]