Developing our own technology solutions, 529 passthroughs, fives issues our Portfolio Efficiency Audit identified in an executive’s portfolio, AI’s impact on careers for college students, will the next recession affect digital advertising?

Dear Friends and Client Partners,

We recently completed a Portfolio Efficiency Audit for an executive that led to them becoming a client. I’ll use today’s deep dive to go through five of the most impactful findings from this audit.

If you’re a client, these will look familiar – we complete these and other audits for you during onboarding as we take over your portfolio and then regularly run new analyses and optimizations on your portfolio that we discuss together during quarterly reviews.

If you’re not a client, these may be a useful reference to check up on your current or strategy. These are common gaps we see across nearly every portfolio we have taken over from other advisors. Depending on severity, these gaps can add up to tens of thousands per year in opportunity costs for multi-million dollar portfolios.

But first, a couple company updates:

Firm Updates

Technology: Two New Analytics Modules

I spent nearly 20 years leading technology and analytics teams before becoming a wealth manager. It should come as no surprise that I’ve started codifying some of Kangpan & Co.’s most common processes and analyses into proprietary technology that we will be using to ensure your family’s wealth is optimally aligned to your long term goals. This technology sits alongside the best-in-class platforms we already use to serve you, filling in gaps that these other platforms have rather than aiming to replace them.

There are two analytics modules that are now being tested on your accounts:

- Tax-Efficient Asset Location: A rebalancing algorithm that monitors your allocations across account types (taxable vs. retirement) to help optimize for after-tax returns on your total portfolio.

- Stagnant Capital: A monitoring system that looks across every account we oversee and flags any cash sitting on the sidelines that should be invested.

The Deep Dive below details what client problems these modules help solve. We built these because we couldn’t find acceptable solutions elsewhere that met the standards with which we want to serve you. We’ll continue adding to our technology going forward.

In Brief: 529 Passthroughs

Based on recent conversations, I’ve realized many people overlook the 529 as a powerful in-year tax management tool, including the expanded $20,000 K–12 limit effective this year.

Even if you didn’t fully pre-fund an account years ago, you can use a 529 as a “tax-advantaged payment account” for tuition or other qualified expenses. By passing these costs through your 529, you capture immediate state tax deductions on dollars that were going to be spent anyway.

If you’re not a client and are currently in the middle of paying educational expenses, let’s ensure you aren’t leaving easy tax savings on the table. Reach out if you’d like to understand any opportunities you may have.

Deep Dive

Five Structural Inefficiencies in an Executive’s $2.9m Core Portfolio

Today’s deep dive is on the longer and more technical side. It is for those of you interested in the details of what we’re doing behind the scenes and how that may differ from what other advisors do.

Note, I’ve provided illustrative examples of the kinds of impact these analyses can have for a $2.9m portfolio rather than the specific numbers we found for this client. This is out of both respect for client privacy and regulatory constraints that limit how much detail I share about a client’s analysis.

That said, this client told us the clarity of our audit and the quantified impact of the findings directly led to them joining Kangpan & Co.

The five analyses from our audit we’ll highlight here are:

- Performance Benchmarking

- Loss Harvesting

- Tax-Efficient Asset Location

- After-Tax Yield Optimization

- Stagnant Capital

I. Performance Benchmarking

The first step of any audit is a cold, hard look at reality. We compare the performance of the current portfolio against an objective benchmark comprised of low-cost, passive ETFs across:

- Global Stocks

- US Stocks

- Bonds

This is a fairly straightforward exercise but we’ve found that most clients have never really sat down to do this. Even clients working with other advisors have rarely seen their portfolio results compared to a simple benchmark portfolio (three guesses why your current advisor may want to obscure this information).

Being an effective multi-asset portfolio manager means understanding where to accept the market return and where active management is more likely to add value to a portfolio.

Certain benchmarks are statistically hard to beat. S&P found 88.3% of active managers underperformed the S&P 500 index over the past 15 years.

However, that same report shows 40.7% of US Muni Managers beat their index over the same 15 year timeframe.

Knowing the benchmarks is important because the costs of underperforming are significant. A $2.9m portfolio moderately underperforming its benchmarks could be losing:

- $14,500 a year if you underperform by 0.5%

- $29,000 a year if you underperform by 1.0%

- $43,500 a year if you underperform by 1.5%

When we add or remove assets from our portfolios we are looking at how that individual asset has performed vs. a set of relevant benchmarks and potential opportunity costs across private and public markets. For example, a Private Real Estate fund will be compared against a broad, low-cost REIT index. But we also look at how incorporating an asset affects the overall portfolio’s structure. Does adding this asset increase overall returns? Does it decrease risks or correlations to economic shocks?

If we’ve done a quarterly review together, then you know we transparently report out how our multi-asset portfolios perform against passive benchmarks. We think it’s important to remain intellectually honest with you and ourselves so that we have the data to consistently improve our investment strategies and processes.

Private Consultation: If you want to benchmark your current portfolio against performance indexes or identify other tax and fee inefficiencies, you can schedule a 30-minute diagnostic session with me below. We waive the fees on our diagnostics for up to three qualified investors a month.

> Schedule a consultation

II. Loss Harvesting

It’s never fun to look at your portfolio and see losses in your positions. Loss harvesting is the process of strategically making use of these losses to:

- Deduct up to $3,000 a year from your income taxes

- Help rebalance your portfolio while minimizing capital gains taxes

- Reduce the future taxable gains on other positions

It’s easy to quantify how much tax-loss harvesting opportunity may exist in a portfolio at any single point in time. Just look at the total dollar amount of losses you have.

What’s more complicated is figuring out what to do about these losses such as understanding the tradeoffs between:

- How much you should actually harvest

- Whether to offset a winning position or take the tax deduction

- Which winning positions to offset with losing ones

- Whether to move your losses into cash or another type of position

While you can tell how many losses you have on any given day by checking your portfolio, it’s harder to estimate how much benefit tax-loss harvesting might deliver over time.

Research from JP Morgan suggests someone regularly contributing to their portfolio and taking advantage of active tax loss harvesting could harvest up to 1.0% a year in tax benefits.

For a $2.9m portfolio, that means tax-loss harvesting could deliver:

- $0 if all your assets were stable or steadily increasing all year

- $14,500 a year at 0.5% in realized tax-loss harvests

- $29,000 a year at 1.0% in realized tax-loss harvests

Many advisors or self-managed investors will only do tax-loss harvesting just once a year. While that’s better than not doing it at all, we feel more regular tax-loss harvesting throughout the year bring better benefits to clients. This better captures ongoing tax opportunities, maintains target asset allocations, and continuously reduces the cost basis of appreciated positions.

III. Tax-Efficient Asset Location

This analysis checks to make sure assets that are:

- Tax-inefficient, such as bond ETFs that generate substantial taxable dividends, are placed in tax-advantaged accounts such as 401ks, IRAs, and Roths

- Tax-efficient, such as large cap growth stocks that typically pay very low dividends, are placed in taxable accounts

There are two primary benefits to doing this. First, the dividends / distributions from assets that create significant taxable payments like bond funds are no longer taxed. Second, we can rebalance assets without incurring capital gains taxes.

Let’s look at the math behind shielding dividends from taxes.

Like many of you who subscribe to this letter, let’s say your family’s income is in the high six figures and you live in a high-tax state. Your federal tax rate is 35% and your state tax rate might be something like 7.5%.

If you put $1,000,000 into a bond ETF with a 4.0% yield, you would get $40,000 in dividends over the course of the year.

- If you hold this position in a taxable investment account you could end up paying $17,000 in taxes ($40,000 * combined tax rate of 42.5%) which means you’ll only keep $23,000

- If you hold this position in a tax-advantaged account you would pay $0 in taxes on these dividends and keep the full $40,000

The benefits to making use of tax-efficient asset location can be significant.

However, many portfolios we’ve reviewed from clients working with other advisors don’t do this. There are various reasons we can think of for why this may be… but none have to do with what is in the best interest of clients.

The primary challenge is that it is more analytically and operationally complex to manage portfolios this way and many automated trading tools available to advisors are not able to handle portfolio structures like this. Most firms avoid this level of detail because it is hard to scale. We lean into it because we embrace complexity since that’s where value is found for our clients.

Unless there’s a reason to do otherwise, we take advantage of Tax-Efficient Asset Location when managing our clients assets and will go through the work it takes to migrate portfolios to this kind of approach.

IV. After-Tax Cash Yield Optimization

As we mentioned in Client Letter #3: Leaving a C-Level Corporate Career, we regularly optimize the yield of our client’s cash positions.

We model more than a dozen different vehicles to find the optimal one for each client based on their unique tax situation. But we don’t just look at the topline yield number. The after-tax yields on these assets can vary significantly.

Each of these vehicles has a different tax treatment – for example, high yield savings accounts are generally taxed at both the federal and state level while short term treasuries are primarily taxed at the federal level but often exempt from state taxes.

Many of our clients’ cash strategies allocate between $100 to $250k to meet short term liquidity needs.

For someone with $250k in cash, the incremental yield you could get from optimizing for after-tax returns are:

- $2,500 a year if you get an extra 1.0% in after-tax yield

- $5,000 a year if you get an extra 2.0% in after-tax yield

- $7,500 a year if you get an extra 3.0% in after-tax yield

It’s worth noting, we typically find a high yield savings account is not the best vehicle for optimizing after-tax yields.

V. Stagnant Capital

This is when you have cash that has unintentionally built up in your portfolio which is not being invested into higher returning assets. This tends to happen when dividends aren’t being reinvested or when you have retirement accounts from old jobs you’ve forgotten about over the years that haven’t been checked in awhile.

It’s not surprising to see Stagnant Capital in portfolios that our clients were previously managing themselves – they’re busy executives that aren’t constantly thinking about their portfolios. What has been surprising is seeing how many portfolios we take over from other advisors and institutions that have significant amounts sitting in cash.

We don’t just consider this “idle money,” but a significant opportunity cost in terms of reaching your long term goals.

For every $100,000 in Dead Cash, you could be actively losing:

- $3,000 a year in interest if you just moved it to a high yield savings account with 3.0% interest

- $4,500 a year in distributions if you have an income-centric portfolio strategy targeting 4.5% in yearly yield

- $9,000 a year if you have a more growth-centric strategy targeting 9.0% yearly total returns

At Kangpan & Co., we don’t rely on manual oversight or ‘occasional’ checks. We’ve built a systematic cash-monitoring algorithm across our entire firm. This ensures that Stagnant Capital is regularly identified and re-deployed, maintaining the structural efficiency of the portfolio regardless of how busy our clients’ lives become.

After the Audit

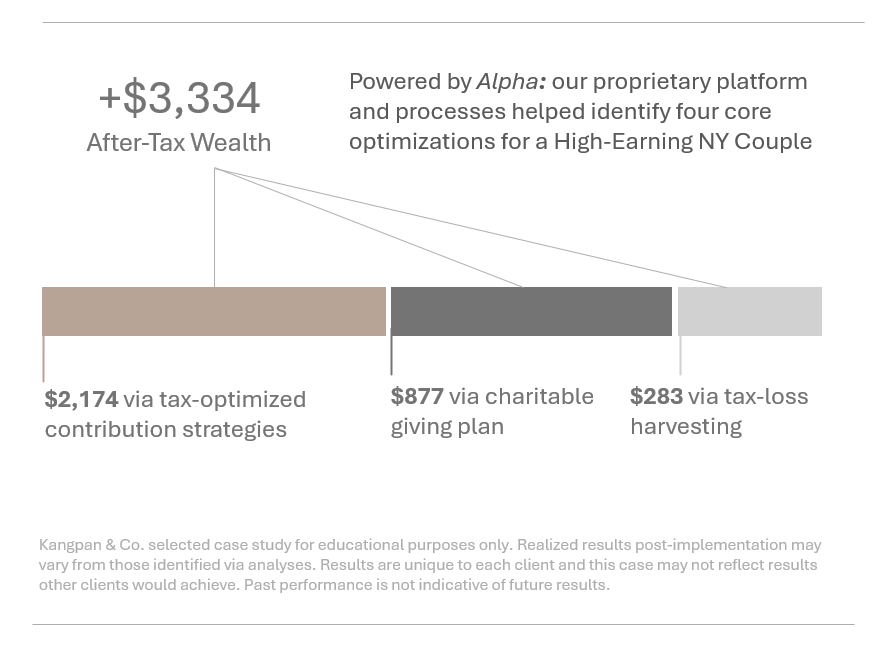

These are just some of the highest level optimizations we identified for this executive’s portoflio before we started officially working together.

Since onboarding this client, we:

- Fixed most of the gaps that our audit identified

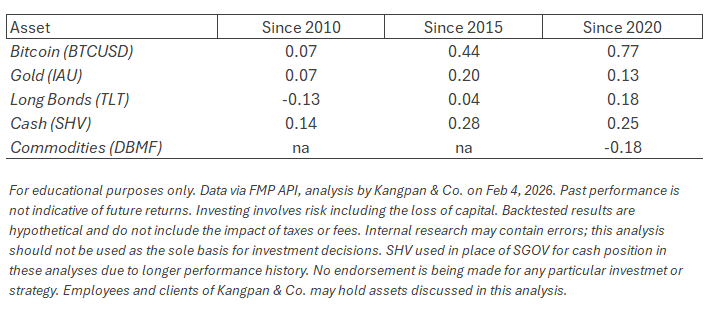

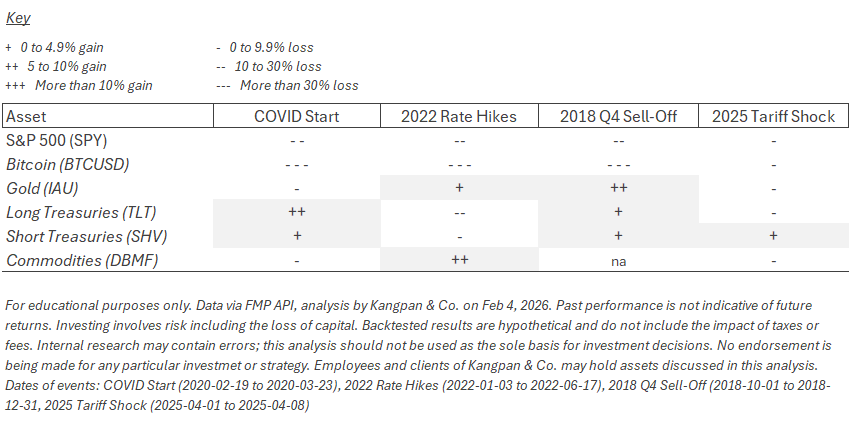

- Developed a new portfolio strategy that incorporates alternative assets to help improve the diversification and resilience of the portfolio to different economic shocks

- Realigned and rebalanced hundreds of thousands of dollars in assets across our client’s portfolio while incurring nearly zero capital gains taxes in the process

- Are exploring integrating private assets to further align the risk / return profile of the portfolio to our client’s long term goals

If you’re not a client and you suspect your portfolio may have performance or efficiency gaps, feel free to email us to request an audit.

If we feel we can add value to your portfolio, we’ll run the same Portfolio Efficiency Audit we used for this executive. We’re currently waiving fees on this audit as we build up our proprietary benchmarking dataset. The analysis takes about an hour of your time in total. Even if we don’t work together afterwards, you’ll know exactly where your portfolio needs to be optimized.

Food for Thought

A collection of articles or books I’ve read that might be interesting to many of you.

- AI job disruption may be good for children via the FT: A number of you with kids in or nearing college and expressed to me some concerns they may be picking career paths for prestige and money rather than what they may ultimately enjoy or be good at in the long run. I’ll be writing more about this topic in a future deep dive and this was a thought-provoking article in the meantime. As the FT writes:

“We have legions of young people who have worked out how to get into great universities, get good grades and land prestigious internships. But when you ask them what they are passionate about, their faces go blank.”

- Are Meta and Google ads really recession proof? via the Economist: A significant portion of subscribers are in the advertising or marketing industry. I’d be curious to get your take on whether digital ad budgets are likely to be cut during the next recession. Reach out if you want to chat about this. As the Economist notes:

“The recessions of 2008-10 and 2020 are also an imperfect sample from which to extrapolate the future of digital ads. It is true that in both those cases online advertising held up even as offline varieties fell off a cliff. Yet in 2007-09 digital ads were climbing from a tiny base, so migration of advertising from print and television to the internet offset cyclical weakness. Now that digital advertising is so dominant, there is less offline share to snaffle.”

Thank you for the continued partnership and for the opportunity to help steer your family’s capital toward what matters most.

Nathan

Founder & Lead Advisor

Not a client yet?

Join the Briefings: Our twice-monthly letters break down the family office-level strategies we develop for our clients with $1M to $20M in assets that have outgrown standard retail advice. See how we’re engineering our HNW clients’ capital to match the lifestyles they want.

> Sign up herePrivate Consultation: If you want to benchmark your current portfolio against performance indexes or identify other tax and fee inefficiencies, you can schedule a 30-minute diagnostic session with me here. We waive the fees on our diagnostics for up to three qualified investors a month.

> Schedule a consultation

Disclosures: This content is for educational purposes only and is not investment, tax, or legal advice. No post is an endorsement of any particular strategy or security. We do not receive any direct payments or commissions for securities discussed in our posts. Employees and clients of Kangpan & Co. may hold positions in securities discussed in posts. Speak with a licensed tax, legal, or financial advisor before making any changes to your investments or financial strategies. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.