This is a primer on 83(b) elections including what they are, what you should consider when making an election, and key rules and regulations to be aware of before making an election. A thorough analysis of whether to make an 83(b) election and its associated tradeoffs is part of our Equity Compensation Diagnostic that we offer on a flat-fee basis.

What is an 83(b) election?

Filing an 83(b) election allows you to pay the income taxes on the value of your equity or option grants today rather than the value that are at when they vest in the future. Why would someone want to do this?

Let’s say you’re a VP who works for Public Big Tech Company with each share valued at $1,000 today. You were just given a one-off Restricted Stock Award (RSA) of 500 shares that vests in one year and your effective tax rate is 35%.

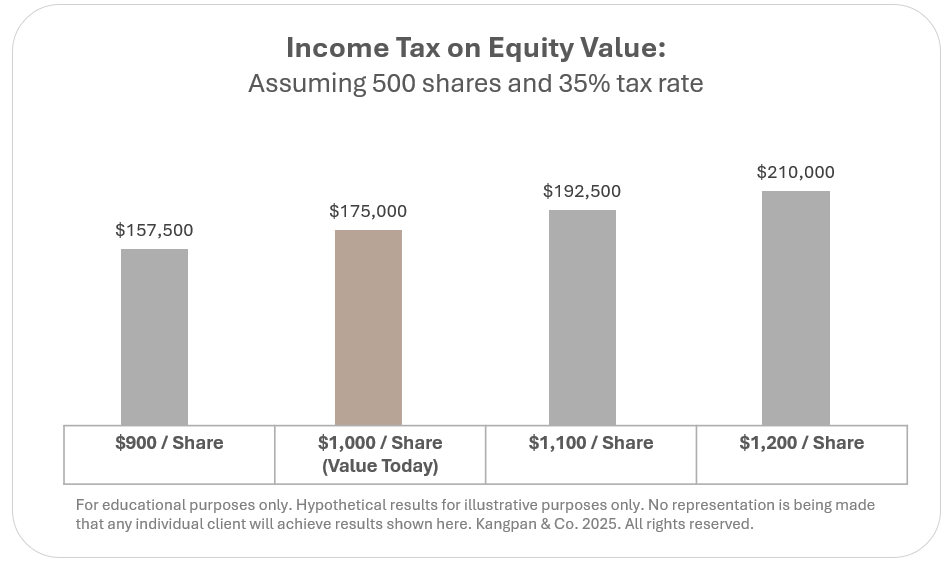

You would owe $175,000 today if you make an 83(b) election and pay taxes on those shares today. Whether that’s a good decision depends on what the expected value of those shares are in the future. The chart below shows the taxes you’d owe depending on the value of each those shares in the future.

If the shares go up 20% in the next year, you’ll owe $210,000 at that time in income taxes (or $35,000 more than paying today). But if the shares go down, you would have paid more in taxes today than if you would have just waited. This means, of course, making an 83(b) election should only be done if you are bullish on the prospects of the equity value of the company giving you the awards.

Optimizing Outcomes

Per the above chart, one of the most critical inputs in deciding to file an 83(b) election is your view on the future value of the grants. But what else might you want to consider as part of the 83(b) decision to optimize your decision-making?

- Opportunity costs: You should consider what else you could do with the tax payment you’re making whether that’s just having the cash on hand for liquidity needs or investing in other assets.

- Concentration risks: If you already have a large share of your net worth attached to the company, you are going to be further increasing that concentration by making an 83(b) election for positions you will not be allowed to sell out of until they vest

- Leaving the company: If you leave the company after you’ve paid the 83(b) election but before your shares have fully vested, you will lose out on both the remaining shares and the taxes you’ve already paid as the IRS will not refund you the tax payment

- Alternative Minimum Tax: Certain actions like exercising ISOs early and then filing an 83(b) election can trigger the AMT; you should be aware of what these actions, thresholds, and liabilities are before doing anything

Make sure you think through these considerations before deciding to do an 83(b) election. These analyses (and many others) are part of our Equity Compensation Diagnostic that we use to help our clients get the most out of their equity comp strategy.

Official 83(b) Rules & Regulations

Like all tax laws and regulations, there are some critical steps and rules to note about 83(b) elections:

- You must make the election within 30 days of the grant; this is a strict deadline, no extensions

- You will need to have the cash on hand to pay the income taxes on the election at the end of the calendar year

- 83(b) elections are irrevocable, make sure this is what you actually want to do

- 83(b) elections are made for the full award, you can’t elect to do just X% of the shares or options that make up the grant

- 83(b) elections are only for grants and awards for which there “is a substantial risk of forfeiture;” not every type of equity or option award or grant qualifies (for example, RSUs typically do not fall under this categorization) it is highly recommended you speak to a qualified advisor about your situation

Email us to schedule a complimentary 30-minute introductory call if you’d like to learn more about 83(b) elections or explore how to better optimize your equity compensation strategy.

email: [email protected]

Disclosures:

This content is for educational purposes only and is not investment, tax, or legal advice. Employees and clients of Kangpan & Co. may hold positions in securities discussed in this post. Speak with a licensed tax, legal, or financial advisor before making any changes to your investments or financial strategies. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.