This post details our approach to maximizing the after-tax and after-fee efficiency of a client’s investment portfolios using a Diagnostic. Check out our primer posts on Systematic Optimization and Diagnostics to learn more about our unique approach to financial advisory.

Our Portfolio Efficiency Diagnostic examines opportunities to improve after-tax returns across your portfolio while also systematically looking for places to reduce overall fees and performance drags. Industry research shows the optimizations included in this Diagnostic could have a sizable impact on long-term portfolio returns through improvements such as:

- Tax-Efficient Asset Location: which can result in 0.14 – 0.41% boosts to yearly after-tax returns according to Schwab

- Tax-Loss Harvesting: that could lead to 1-2% a year in potential tax savings over 10 years according to JP Morgan

- Fund Type Optimization: which could reduce fees by 0.51% a year, the average difference in fees between mutual funds and ETFs according to Morningstar

As with all our Diagnostics, our structured approach ensures we are comprehensively examining your situation in a methodical way, quantifying the tradeoffs that matter, and then aligning your path forward to your unique goals. Our Diagnostics evolve over time as we identify additional analyses and Systematic Optimizations through our ongoing research and work with clients.

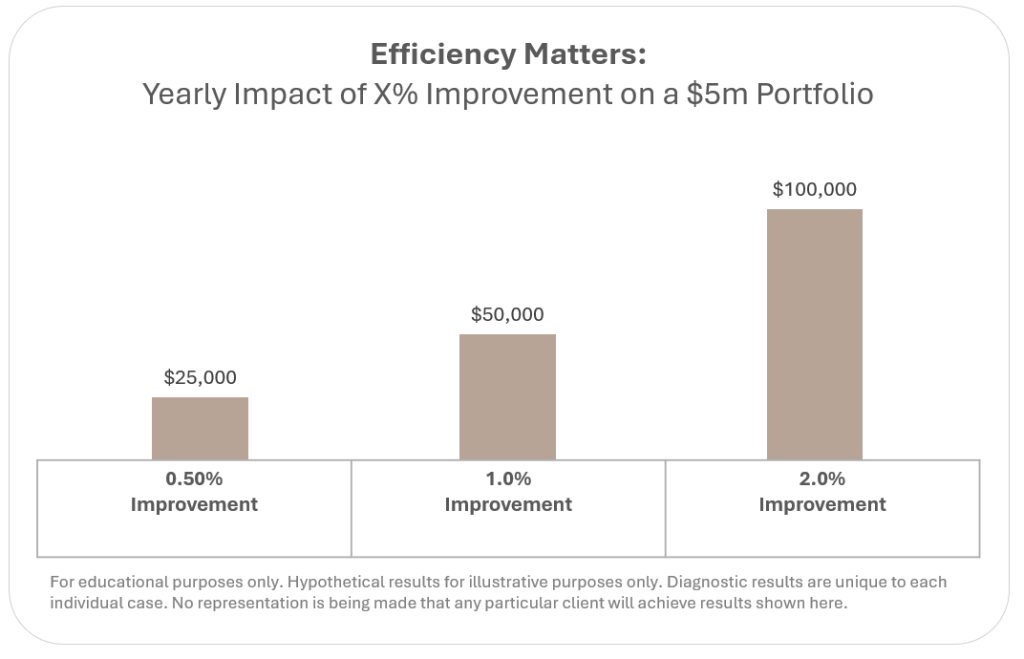

Seemingly small efficiency improvements can have significant immediate and long-term impacts on a portfolio’s returns. As the chart below shows, just 0.50% improvement on a $5 million portfolio could result in $25,000 a year in additional after-tax wealth accruing to an investor.

The Portfolio Efficiency Diagnostic

Our Portfolio Efficiency Diagnostic currently contains ten primary Systematic Optimizations supported by dozens of detailed analyses as shown in the table below. All analyses and recommendations are provided to the client as part of our deliverable.

Table 1: Our Portfolio Efficiency Diagnostic as of October 2025

| Systematic Optimizations | Supporting Analyses |

| 01: Minimize Index Fees | – Identify index-tracking funds within portfolios – Compare expense ratios and fund fees vs. similar funds – Determine cost-savings opportunities from moving to lower fee alternatives – See example |

| 02: Fund Type Optimization | – Compare fully-loaded fees on any mutual funds being held with their ETF equivalents – Quantify cost impact of switching to lower fee alternatives |

| 02: Optimize Custodian Fees | – Assess trading and brokerage fees across accounts – Calculate admin / custodial fees across accounts – Determine cost-savings from migrating accounts and providers |

| 03: Cash Yield | – Calculate total cash holdings and corresponding after-tax yield – Compare after-tax yield of alternatives – Optimize cash positions across accounts to maximize after-tax yield – See example |

| 04: Tax-Efficient Asset Location | – Calculate current tax load on equity dividends and bond distributions across accounts – Determine potential tax efficiencies from moving higher yield and higher tax investments to tax-advantaged accounts – See example |

| 05: Tax-Efficient Asset Types | – Calculate current tax load on fixed income bond fund distributions across accounts – Compare potential tax efficiencies from moving to municipal and other tax-advantaged, fixed income instruments |

| 06: Tax-Loss / Tax-Gain Harvesting | – Identify positions and lots with losses – Identify positions and lots with gains – Quantify opportunities for optimal tax-loss / tax-gain management – Determine opportunities for loss deductions and carryovers |

| 07: Asset Performance Benchmarks | – Compare performance of individual, non-index funds to indexed equivalents – Understand performance optimization opportunities from moving to passive index equivalents |

| 08: Portfolio Performance Benchmarks | – Compare performance of overall portfolio to common benchmarks i.e. 60/40 or our Core Portfolios to understand performance and risk optimization opportunities |

| 09: Account Types | – Catalog current accounts and types (i.e. tax advantaged vs. brokerage, etc.) – Identify any gaps in account types that could improve after-tax results |

| 10: Contributions and Funding Strategies | – Ensure funding and contribution strategies are maximizing after-tax results or aligned to long term goals (i.e. early retirement, withdrawal needs, etc.) |

Client Implementation

This Diagnostic is available to our financial planning clients as part of their ongoing deep dives.

If you’re not already a client, you might currently be paying for management and planning that is not delivering these systematic optimizations. The only way to stop the hidden drags in your portfolio is through an objective, rules-based audit.

Our Portfolio Efficiency Diagnostic is available for a flat-fee engagement (typically $1,000 to $10,000), which is always priced to be significantly less than the expected quantifiable tax and fee savings we identify.

Stop guessing about your hidden tax, fee, and performance drags and start executing an optimized playbook to address these issues. Email us to schedule a complimentary 30-minute Portfolio Efficiency Diagnostic Preview to learn more about what we could do for you.

email: [email protected]

Disclosures:

This content is for educational purposes only and is not an investment recommendation. Employees and clients of Kangpan & Co. may hold positions in securities discussed in this post. Speak with a licensed financial advisor before making any changes to your investments. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.