A Brief Message From

Our Founder

One of the reasons I got into wealth management was the desire to have a direct and measurable impact on the financial lives of the clients I serve. This case study is an example of how we use our proprietary capabilities to uncover core tax optimizations that our clients’ previous advisors typically overlook. There is nothing more rewarding than providing immediate, tangible results within the first few conversations with a new partner.

– Nathan Kangpan

Our Clients Were

Being Underserved

By Their Prior Advisor

Our clients are a high-earning, married couple in their 30’s living in New York. They have a combined income in the high six figures and gross investable assets approaching $1m. They came to us because they were unhappy with the advisor they were working with at the time, sensing (correctly) that their old advisor was overlooking many strategies that could help them put thousands more a year towards their financial goals.

Four Core Recommendations

That Drove Thousands In

Tax Optimizations

“It’s crazy just how much better your approach is compared to our old advisor.”

– Client Feedback During Initial Performance Review

We started the relationship by building a comprehensive, dynamic financial plan that would help us fully understood the couple’s financial situation as well as their short, medium, and long-term goals.

Once we had a holistic picture, we were able to focus our proprietary series of diagnostics on the critical tax, planning, and investment optimizations that would help them put thousands more per year towards their goals.

We went through our full suite of tax, investment, and planning diagnostics during the onboarding process. While we delivered value across all three of those categories, we want to use this case study just to highlight the key tax opportunities we identified:

- Saving for College Before the Stork Arrives: The couple are planning to but do not yet have children. As a highly educated couple, they prioritize college savings in their long-term financial goals and were planning on opening a 529 Plan once they had children. Many couples are unaware that you can open 529 Plans before your kids are born to a) get a head start on saving but also b) start taking advantage of the tax benefits now. We modeled out the tax and long-term savings impact of our clients starting their 529 this year and also helped them set up and fund their account to begin taking advantage of all the tax benefits.

- Health, Wealth, and a Triple-Tax Advantage: One of the clients has had an HSA for years into which their employer has been contributing $1,000 a year. However, the client had not been adding any additional funds since they felt they were young and healthy and had no need for putting funds into the HSA. We walked them through the triple-tax advantages of the account and also helped them understand how HSAs can function like an additional retirement account once they turned 65… when the funds can be tapped penalty-free for non-healthcare spending.

- Maximizing Charitable Giving By Waiting for the New Year: Our clients donate to several charities each year. While the amounts are generous, they are not high enough for our clients to itemize. However, in 2026, the OBBBA tax changes will allow couples filing jointly to deduct up to $2,000 in qualified charitable cash donations, even if they take the standard deduction. Based on this change, we advised our clients to wait until Jan 1, 2026 to make some of their planned donations to take advantage of this new deduction policy.

- Continuous Tax-Loss Harvesting: We identified and realized multiple tax-loss harvesting opportunities as we migrated the clients’ portfolios towards our recommended allocations. While many advisors only look at tax-loss harvesting once a year (if that), we implement it year round to continuously capture opportunities as they present themselves.

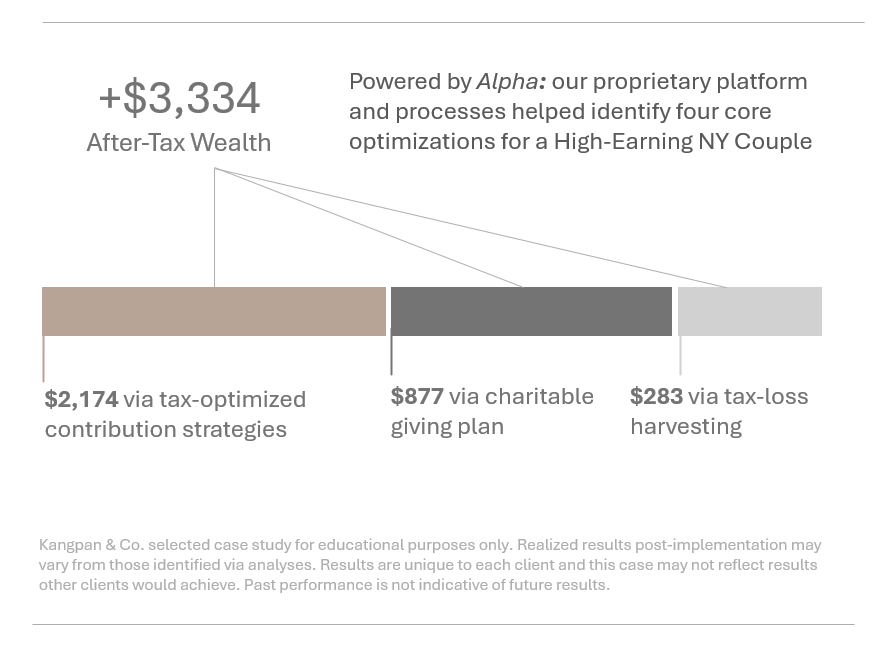

These four optimizations alone added up to more than $3,334 in additional after-tax income that the client was able to build.

See What Tax

Opportunities You

Might Be Overlooking

We are always proud of the incremental value we identify for our clients and love building a trusted, collaborative partnership developing strategies together to help each optimize their financial future.

Have one of our advisors help you with a complimentary, 30-minute Tax-Strategy Diagnostic consultation if you’d like to see what kind of value your current advisor or strategies might be missing.

Disclosures: This is a real-life client case study. The clients in this case study have agreed to be featured in Kangpan & Co.’s materials without any form of direct or indirect compensation. All results are specific to each individual client’s unique circumstances and may not be representative of results other clients would achieve. The clients in this case study have also offered to serve as references to anyone considering Kangpan & Co. and would like to hear what working with our firm is like from actual clients. They receive no form of direct or indirect compensation for serving as a reference.