This post provides more detail on how we develop a Core portfolio strategy for our clients. This post should also help potential clients better understand how our mindset and approach may be different from the typical advisor.

The Role of the Core Portfolio

Designing and managing a Core portfolio is one of the foundational investment management services we provide to clients. As the name implies, the Core portfolio should be the reliable engine to take an investor from where they are today to where they want to be in the future with as minimal drama as possible. The Core portfolio is where an investor will keep the majority of their assets. This means a Core portfolio must adhere to our three key investing tenets:

- Short term returns for any asset class are unpredictable so a Core portfolio needs to be truly and widely diversified across uncorrelated asset classes

- Base rates are a strong guide to long-term returns so we should make decisions on which assets to include and in what proportions based on robust historical data that covers a wide range of business and economic cycles; these assets will be held for the long term and rebalanced to target allocations rather than actively traded

- Avoid permanent losses of capital in this portfolio by focusing on funds of diversified assets and strategies with established, audited track records rather than becoming overly concentrated in individual stocks or securities; we will be methodical in how we administer the portfolio such as minimizing tax drags based on where we locate assets, rebalancing the portfolio, and selecting funds to be included

The Core portfolio is primarily composed of a customized mix of low-cost, diversified ETFs across the following asset categories:

- Equities (Stocks): These are the primary drivers of long-term returns within most portfolios. Depending on a client’s comfort with risks and return objectives, we integrate a mix of equities that span different geographies (i.e. US, International) and different factors (i.e. Large Cap Growth, Small Cap Value)

- Fixed Income (Bonds): These can be used to provide steady income within a portfolio or function as ballast for when equities experience stress periods. Depending on a client’s income needs and risk tolerance we will look to include fixed income options that span a range of durations and credit qualities.

- Alternatives: These are investments we use to further diversify the mix of Stocks and Bonds in a portfolio ideally seeking to increase returns while reducing overall risks. Assets used here could include commodities such as gold, managed futures, structured credit, etc.

Our comfort with alternative investments is one of the traits that makes us different from typical advisors. For examples on how we think about how alternatives can improve the return / risk profile of a portfolio, check out our post about gold’s role in portfolio or our post about how structured credit like AAA CLOs can enhance yields.

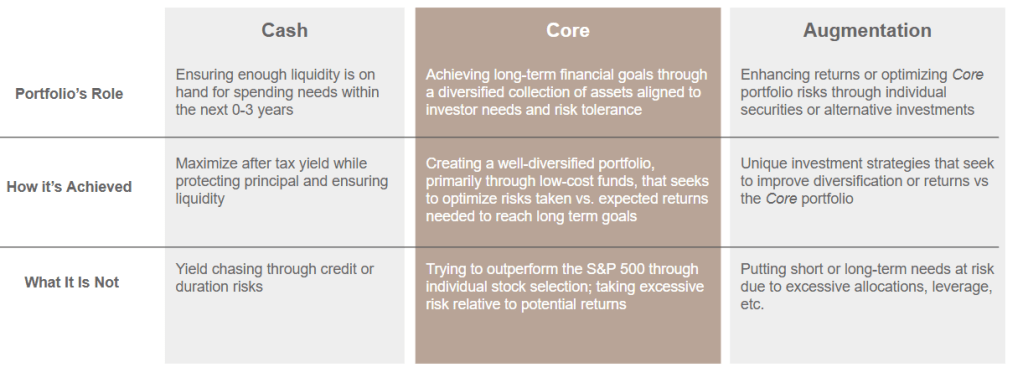

While the Core portfolio generally does the bulk of the heavy lifting for an investor, it’s important to point out that we feel investors should have two other types of portfolios to form a well-rounded investment plan: a Cash portfolio and an Augmentation portfolio. The table below highlights key aspects of each portfolio and we will discuss the other two portfolios in more depth in future posts.

Building a Client’s Core Portfolio

While there are common building blocks across the Core portfolios we manage, we customize each one to the unique needs and risk tolerances of every client. This is typically done by following three key steps.

Step I: Understand a client’s goals and timeframes to establish a target return

In order to determine what return we need from our portfolio, we first need to figure out where we are at and where we are trying to go. Many investors have a vague sense of wanting to “retire earlier” or “build more wealth,” but we need to better quantify those notions in order to create objective targets. Once we know our goals, we can then figure out what return we need from our portfolio. This is something we work closely with our clients to understand before we make any investments.

Let’s go through an example to help illustrate what we’re talking about.

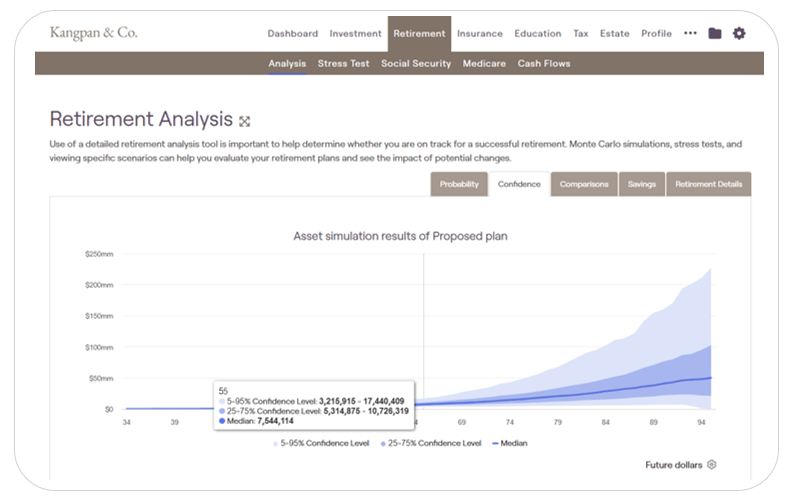

The Johnson’s are a family of two working professionals in their mid 40’s with two kids. They currently have an investable portfolio of $1.8 million and want to retire in 10 years with $7.5 million. They expect to be able to add $200,000 a year to their investable assets between now and then.

Using our dynamic planning tools, we determine together that they will need to earn a return of at least 8.9% a year over the next 10 years to reach their $7.5 million goal.

Illustrative example using Kangpan & Co. planning tools to determine expected asset levels along with associated confidence intervals. Modified for demonstration purposes.

Step 2: Understand a client’s comfort with risk and return to establish a baseline allocation using traditional assets (i.e. Stock and Bond mix)

The baseline rate of return of a Core portfolio is predominantly determined by its ratio of Stocks to Bonds. This forms the baseline allocation of the portfolio. Alternatives, which we discuss in the next step, are used to manage the risk profile of a portfolio.

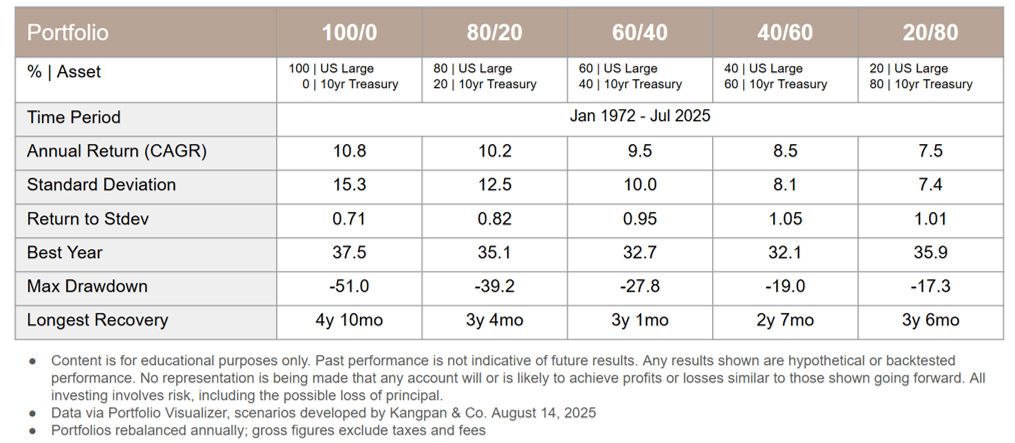

The table below shows the long-term historical performance and key risk metrics of various mixes of Stocks/Bonds that we pulled together using Portfolio Visualizer’s asset backtesting module. We show tables like this to clients to guide conversations about what baseline mix should be used as a starting point to reach their return goals.

Each column represents the results for a different mix of Stocks/Bonds with Stocks represented by US Large Caps (a proxy for the S&P 500) and Bonds represented by 10yr Treasuries. For example, the column 100/0 is a portfolio comprised of 100% Stocks and 0% Bonds while the 60/40 column is a portfolio of 60% Stocks and 40% Bonds.

We can see based on the table that in order for the Johnson family to get their target 8.9% return, they will need to have a portfolio that is somewhere between a 40/60 portfolio (with an 8.5% expected return) and a 60/40 portfolio (with a 9.5% expected return).

Table 1: Return and Risk Profiles for Various Stock/Bond Portfolio Mixes

However, in addition to understanding how returns are affected by the mix of Stocks and Bonds in a portfolio, we also use the data in this table to better understand how our clients feel about risk. Specifically we look at data points like how volatile the portfolio is on a year to year basis, how severe downturns have been (the Max Drawdown metric), and how long each portfolio took to recover from those downturns.

Step 3: Adjust the return and risk profile of the baseline portfolio to the client’s needs by more broadly diversifying the base asset mix and selectively incorporating alternatives

Our first step identified what minimum return level we need to target in order to help our client reach their goals on the timeline they desire. Our second step gave us a better understanding of how the client views the tradeoffs between risks and potentially higher returns. These prior two steps give us the inputs we need for our final step with a client… fine-tuning the risk and reward ratios of a baseline Stock and Bond portfolio by introducing additional diversifiers.

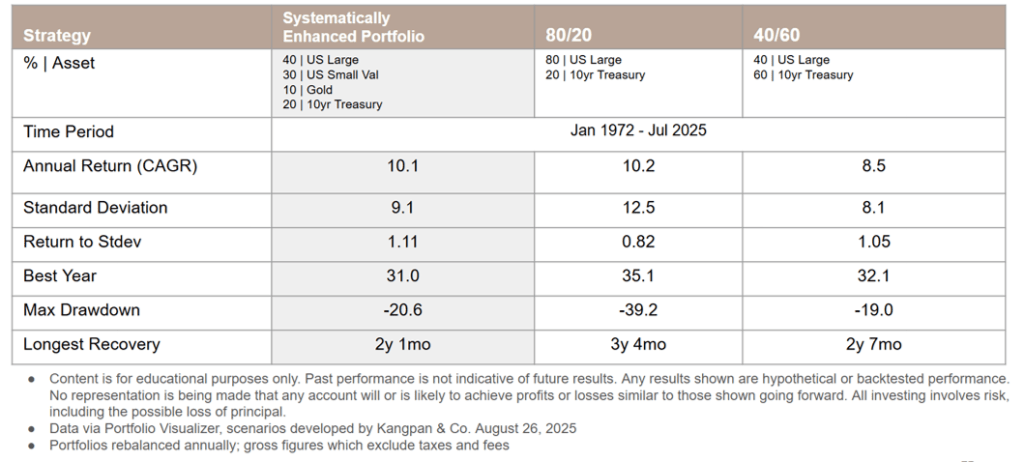

Let’s say in our discussion with the Johnson’s in the prior step that they liked the idea of retiring with $8.3 million instead of $7.5 million if they could earn the historical 10.2% returns of an 80/20 portfolio (who wouldn’t?). However, among other issues, they did not like the amount of additional risk that came with that portfolio’s Max Drawdown of -39.2% vs. the 40/60 portfolio’s -19.0%.

This is where we can use a wider range of funds and alternative assets to help our clients balance the returns they want with the potential risks of a portfolio. In the table below, we are showing a simplified example of enhancing the portfolio with just two additional asset classes:

- US Small Cap Value: research shows US Small Caps and Value factors tend to outperform US Large Caps over time

- Gold: an alternative asset class that can help diversify portfolios consisting of Stocks and Bonds

Strategically incorporating these two additional asset classes allows us to boost backtested returns to the levels of an 80/20 portfolio while having the risk characteristics more aligned to a 40/60 portfolio:

Table 2: Returns and Risks for Systematically Enhanced Portfolio vs. Stock / Bond Mixes

This is where the power of being open to incorporating alternatives comes into play for clients – we can better engineer a portfolio’s returns and risks to meet the unique needs and desires of each client.

We primarily use alternatives in publicly available ETFs rather than private options because they are generally:

- More transparent: so both our advisors and our clients are clear on what is being added to the portfolio

- More liquid: the tradability of ETFs makes rebalancing or strategic shifts in allocations much easier to accomplish

- Lower fee: ETFs tend to (but not always) have lower fees than private funds for similar strategies and implementations

Real-World Client Implementation

The example in the prior section is purely illustrative and for educational purposes only. In the real world, we look across a much broader set of investable options across stocks, bonds, and alternatives. The actual individual securities and funds we use to set up our clients’ positions which will have a different return and risk profile from those based on overall asset class returns used in our example.

Our clients benefit from the ongoing research we conduct for each asset class inlcuding:

- How the asset class relates to the rest of the portfolio by understanding historical correlations, stress periods, return and risk profile, etc.

- How different allocation weights affect the overall portfolio’s risk and return metrics across various time periods

- Our preferred fund or individual security(ies) for gaining access to that asset class

Our selection process for specific securities we use in portfolios depends on the asset class we are researching and our clients’ specific needs. For examples of some of the factors we consider check out our post on selecting an ETF for S&P 500 exposure or our preferred International funds

Once a Core portfolio strategy has been developed, we then help clients implement and manage the portfolio on an ongoing basis including:

- Reporting / Monitoring

- Rebalancing

- Tax-Loss Harvesting

- Adding / Removing Assets Over Time

Our fees and minimums for designing and managing a Core portfolio strategy can be found in the Service Models & Pricing section of our investing services page. We also work with clients on a flat-fee project basis for those that just want access to our portfolio advice and construction process rather than ongoing management.

Email us if you’d like to discuss anything in more detail or learn more about our services.

email: [email protected]

Disclosures:

This content is for educational purposes only and is not an investment recommendation. Employees and clients of Kangpan & Co. may hold positions in securities discussed in this post. Speak with a licensed financial advisor before making any changes to your investments. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.