Executive Summary

Municipal bonds are often recommended to higher earners by advisors due to their tax benefits (the interest payments are excluded from federal taxes). But, unless you’re living off the income from your portfolio, you could be earning a higher yield by sticking with taxable bond funds held in non-taxable accounts.

Increasing After-Tax Yields By $4,250 on a $500k Bond Position

Let’s go through a detailed, hypothetical example.

Investor Profile:

Let’s say you and your spouse are in your late 30s and together earn $460,000 a year. This puts you in the 32% federal tax bracket if you’re filing jointly. We’ll ignore the net investment income, state and local tax for now to keep things simple.

You have $2.5m in total investable assets of which:

- $1.25m is in tax-advantaged retirement accounts

- $1.25m is in taxable accounts

- You are targeting a 60% stocks / 40% bonds allocation across your investments

- This equates to $1m total in bonds across your account types or roughly $500k in retirement accounts and $500k in taxable accounts

Investment Options:

Let’s compare two ETFs that are reasonable municipal and taxable bond equivalents. Here are the the key stats as of Dec 5, 2025 for these two options:

- The iShares National Muni Bond ETF (ticker: MUB) has a 30-day SEC yield of 3.32%

- The iShares Core US Aggregate Bond ETF (ticker: AGG) has a 30-day SEC yield of 4.17%

Note, these two do have slightly different characteristics when it comes to underlying credit risks, overall duration of the fund, etc. But they are similar enough across these traits that many advisors would likely use them interchangeably depending on a client’s tax status.

Analyzing Pre and Post-Tax Yields:

Let’s take a look at the numbers.

Table 1: Pre and Post-Tax Yields Between Bond Fund Types

| iShares National Muni Bond ETF (MUB) | iShares Core US Aggregate Bond ETF (AGG) | |

| Amount Invested | $500k | $500k |

| 30 Day SEC Yield (as of Dec 5, 2025) | 3.32% | 4.17% |

| Implied Yearly Pre-Tax Payments at 30D SEC Yield | $16,600 | $20,850 |

| Implied Yearly After-Tax Payments (Assuming 32% Federal Tax Rate) | $16,600 | $14,178 |

The table above provides a clear illustration of why many advisors and DIY investors prefer to hold municipal bonds in taxable accounts.

The after-tax yield (last row) is $2,422 higher than than the taxable bonds since the municipal bond funds are generally exempt from federal taxes. This is despite the pre-tax yield on the taxable bonds being $4,250 more than the muni bonds.

This is where a lot of advisors or DIY investors would stop the analysis. It’s pretty clear here that this family should put their bond allocation into munis instead of taxable bonds.

Going One Step Further:

What if we could keep all of the $20,850 from the taxable bonds instead of paying taxes on it?

You can do this by treating your accounts as one integrated portfolio rather than two separate taxable vs. retirement account buckets.

Instead of holding a consistent ratio of 60% stocks and 40% bonds across each of your taxable and retirement accounts, you can optimize by putting your all of your higher yield, higher tax investments (like taxable bond funds) in your retirement accounts and move more of your lower yield, lower tax investments (like stock index funds) into your taxable accounts.

Let’s illustrate what we’re talking about with another quick table.

Table 2: Portfolio Allocation Strategies

| Current Portfolio Strategy | Tax and Yield Optimized Strategy | |

| Total Stocks & Bonds Across Accounts ($2.5m Total) | $1.5m Stocks $1.0m Bonds | $1.5m Stocks $1.0m Bonds |

| Taxable Accounts ($1.25m Total) | $500k Bonds $750k Stocks | $1.25m Stocks $0 Bonds |

| Retirement Accounts ($1.25m Total) | $500k Bonds $750k Stocks | $1.0m Bonds $250k Stocks |

In the table above, the Current Portfolio Strategy holds a 60% stocks / 40% bonds mix across both their taxable accounts and retirement accounts. The Tax and Yield Optimized Strategy swaps all the bonds out of the taxable accounts in place for stocks.

The total amount of money allocated to stocks and bonds stays consistent between the two strategies so you can maintain your overall risk profile. We are just moving the bond allocation out of the taxable accounts and into the retirement accounts where they are sheltered from taxes allowing you to capture all of the incremental yield they produce.

In this case, this strategy means instead of accepting the lower overall yield of $16,600 from the muni bond fund held in your taxable account, you could capture the full $20,850 yield from the taxable bond fund by holding it in your non-taxable account.

This is what smart, tax-efficient investing is all about.

Real World Implications

This was an overly simplified example to help illustrate how tax-smart strategies can improve portfolio yield. In the real world, you would need to take into account other factors such as:

- The total return of investments outside of the yield

- What investments you have available in your retirement accounts

- Capital gains taxes from making large allocation shifts in your taxable accounts

- The yield on your stock allocations

- Your specific federal, state, local, and other tax situation

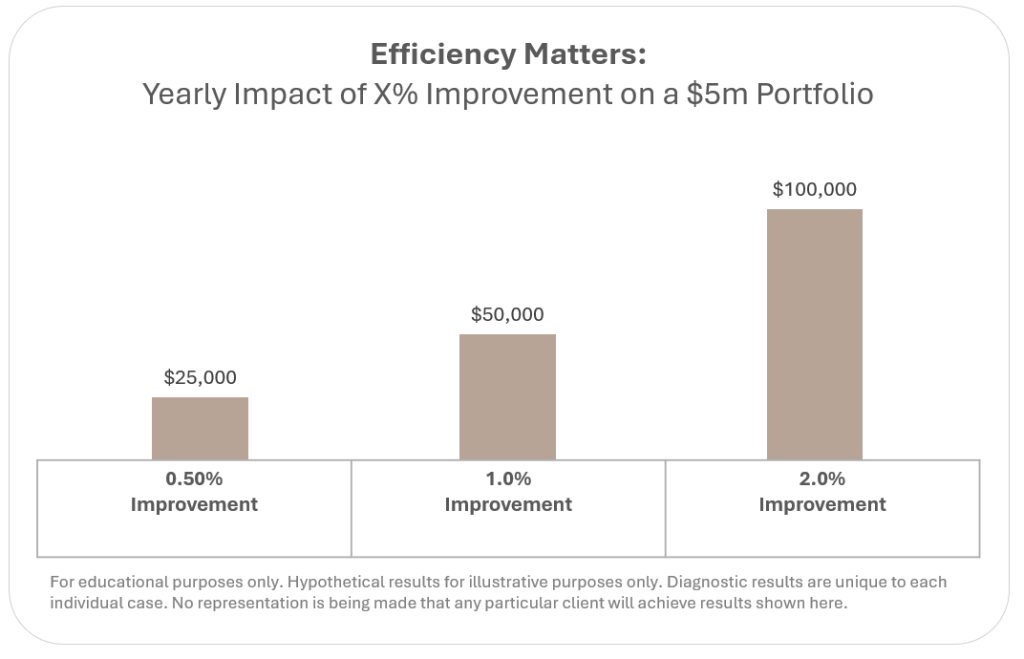

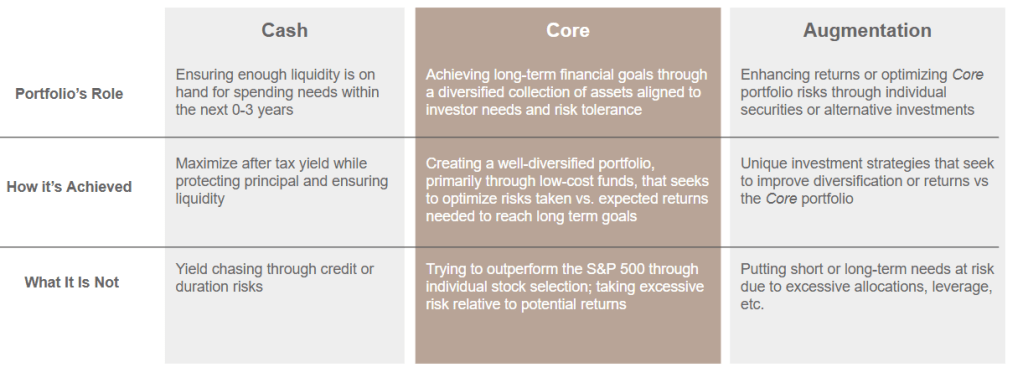

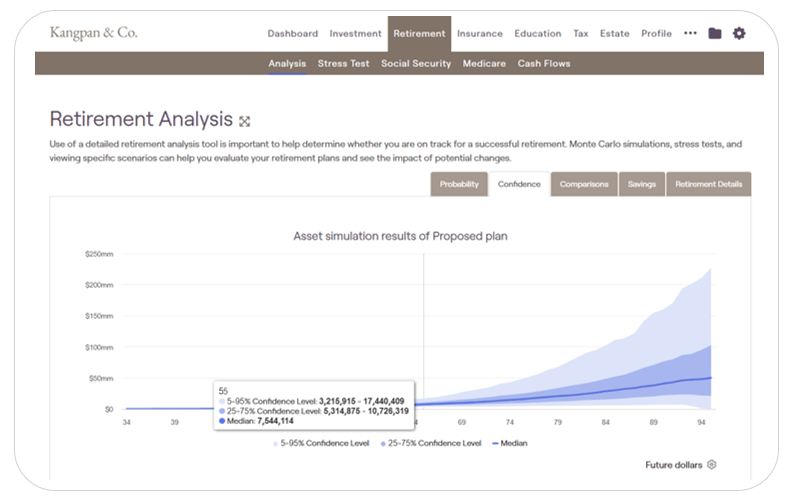

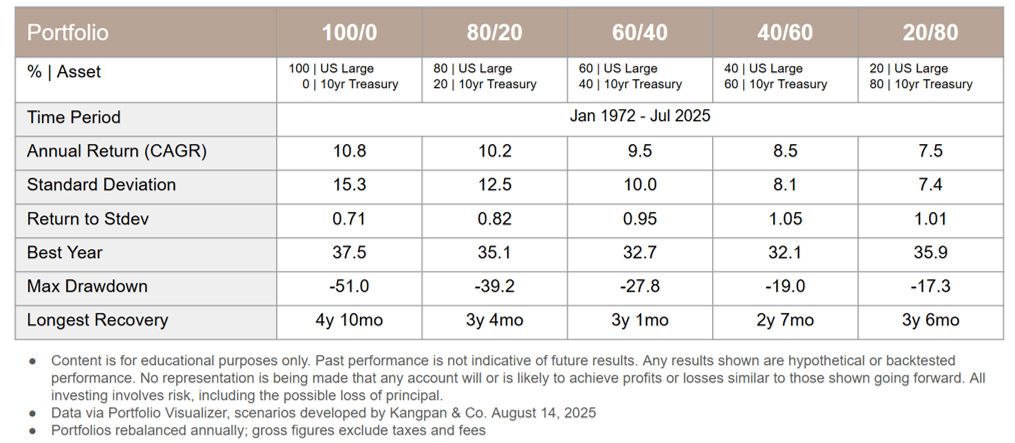

This, and other analyses like it, are part of the Tax, Portfolio, and Planning optimizations our advisors run for clients assisted by our proprietary Alpha platform.

Reach out to us if you’d like a complimentary, 30-minute lightweight Diagnostic consultation to learn more about how our unique tech-augmented process helps investors identify high value tax, portfolio, and planning opportunities that other advisors and strategies miss.

Email us at: [email protected]

Disclosures:

This content is for educational purposes only and is not investment, tax, or legal advice. No post is an endorsement of any particular strategy or security. We do not receive any direct payments or commissions for securities discussed in our posts. Employees and clients of Kangpan & Co. may hold positions in securities discussed in posts. Speak with a licensed tax, legal, or financial advisor before making any changes to your investments or financial strategies. Past performance is no guarantee of future returns. Investing involves risk including the loss of capital.